| Prudential Bancorp, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than Registrant) |

| No fee required. |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: _____________________________ |

| (2) | Aggregate number of securities to which transaction applies: _____________________________ |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): _______________ |

| (4) | Proposed maximum aggregate value of transaction: ____________________________________ |

| (5) | Total fee paid __________________________________________________________________ |

| Fee paid previously with preliminary materials: _________________________________ |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: _________________________________________________________________ |

| (2) | Form, Schedule or Registration Statement No.: ________________________________________________ |

| (3) | Filing Party: _____________________________________________________________ |

| (4) | Date Filed:_________________________________________ |

Very truly yours, Dennis Pollack  | ||

PRUDENTIAL BANCORP, INC. 1834 West Oregon Avenue Philadelphia, Pennsylvania 19145 | ||

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS | ||

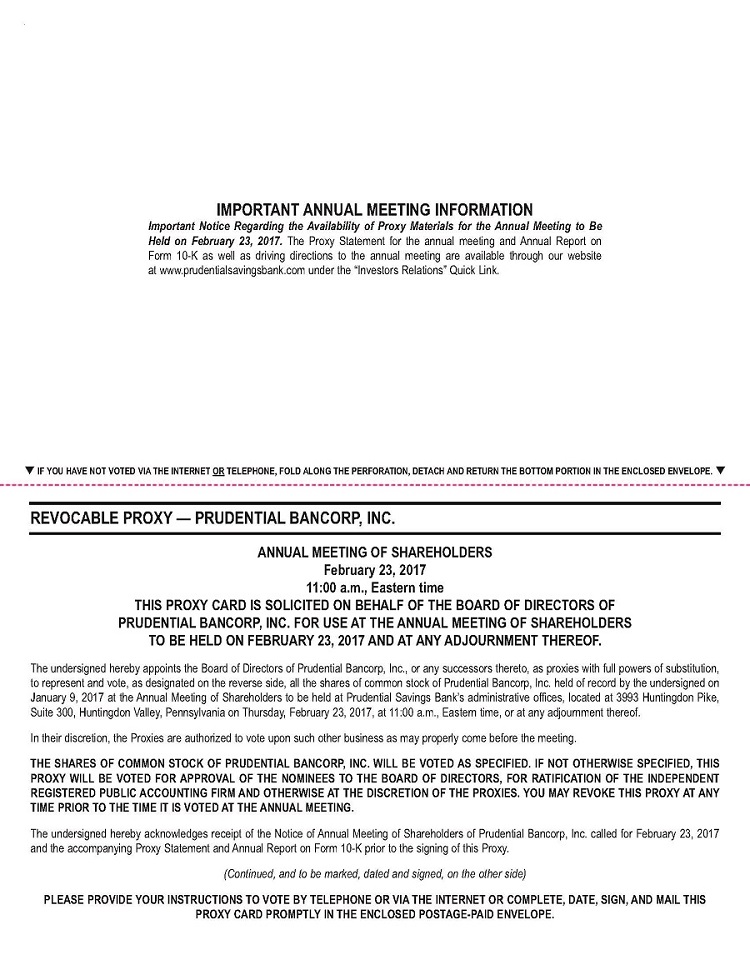

TIME | 11:00 a.m., Eastern Time, | |

PLACE | Prudential Savings Bank Administrative Offices | |

ITEMS OF BUSINESS | ||

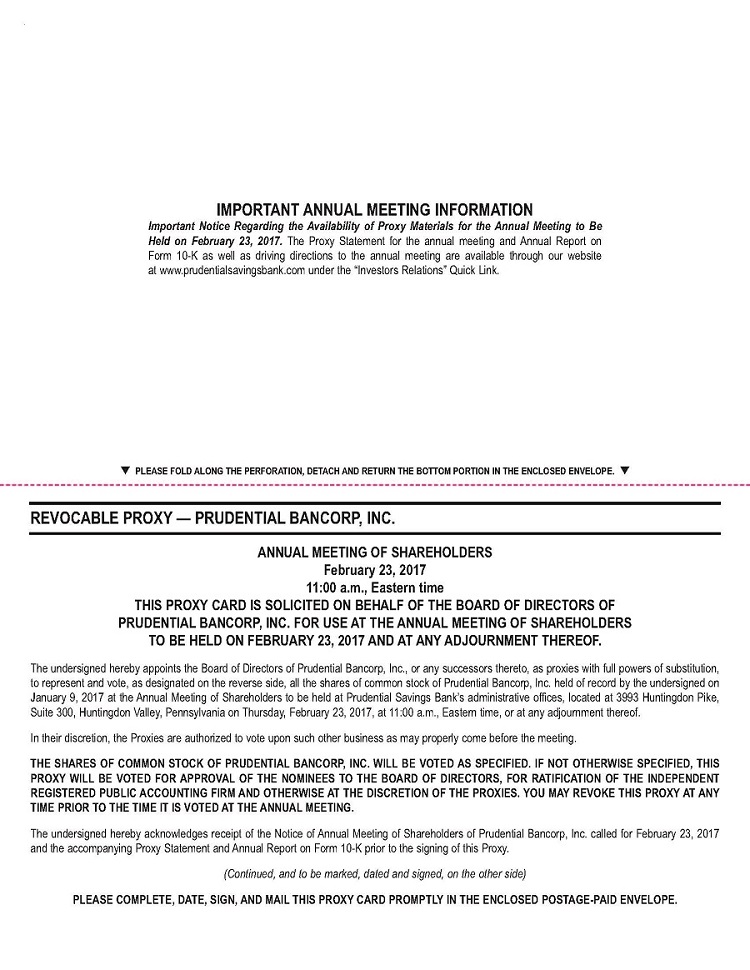

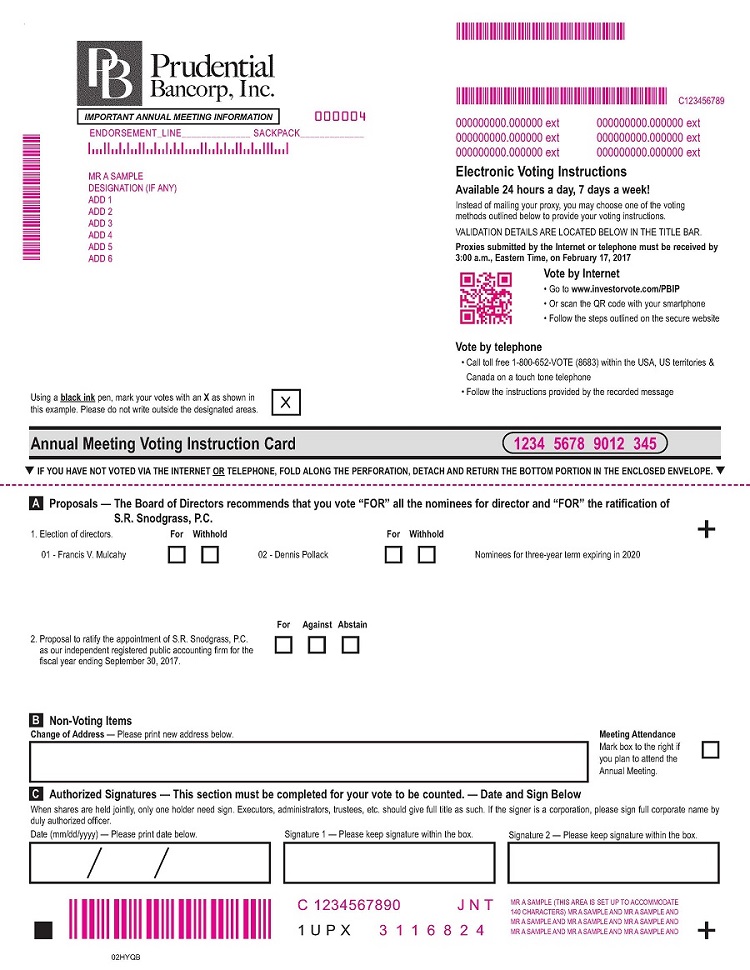

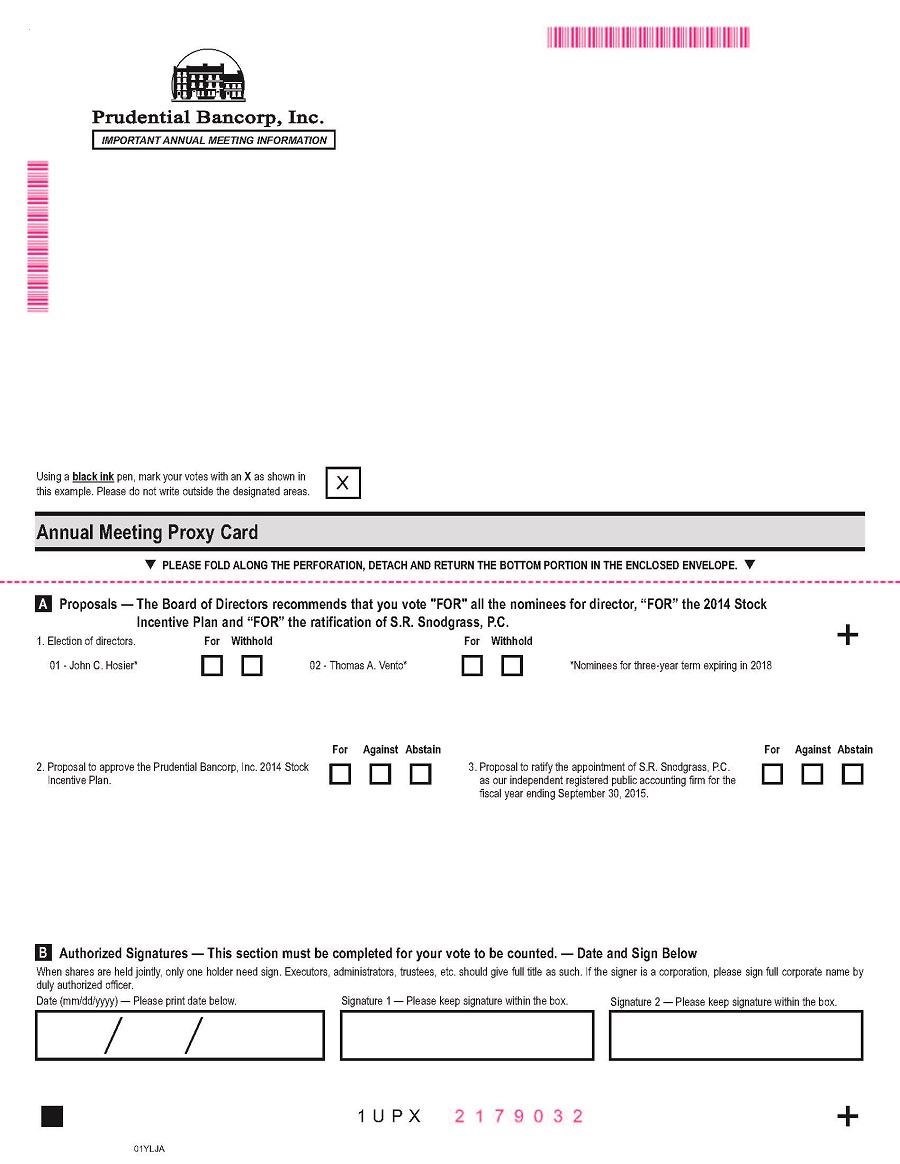

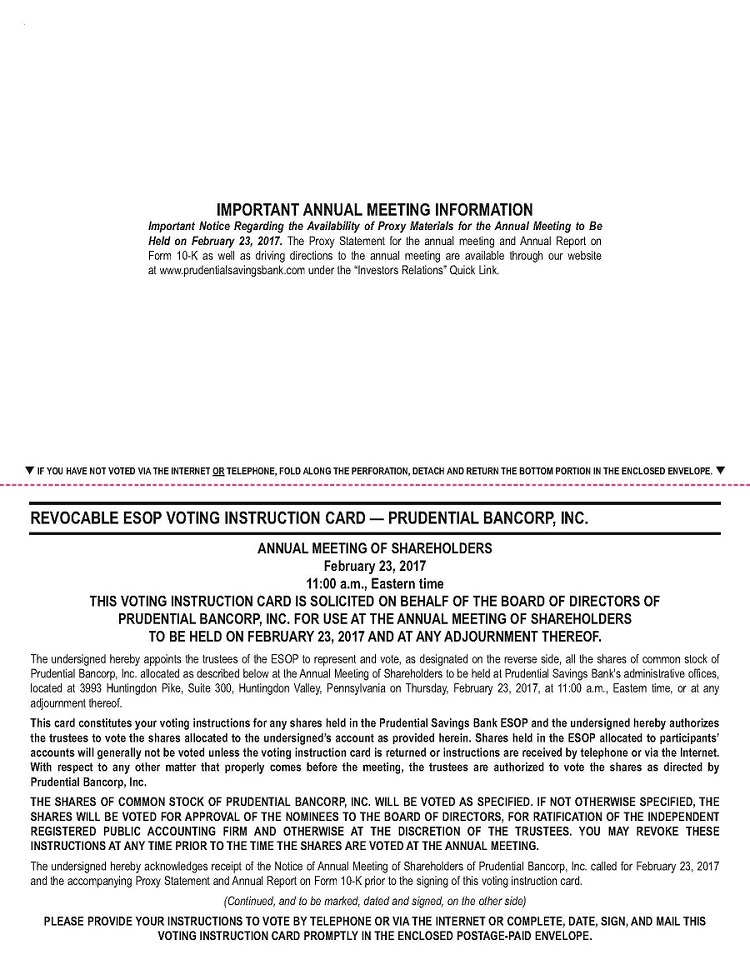

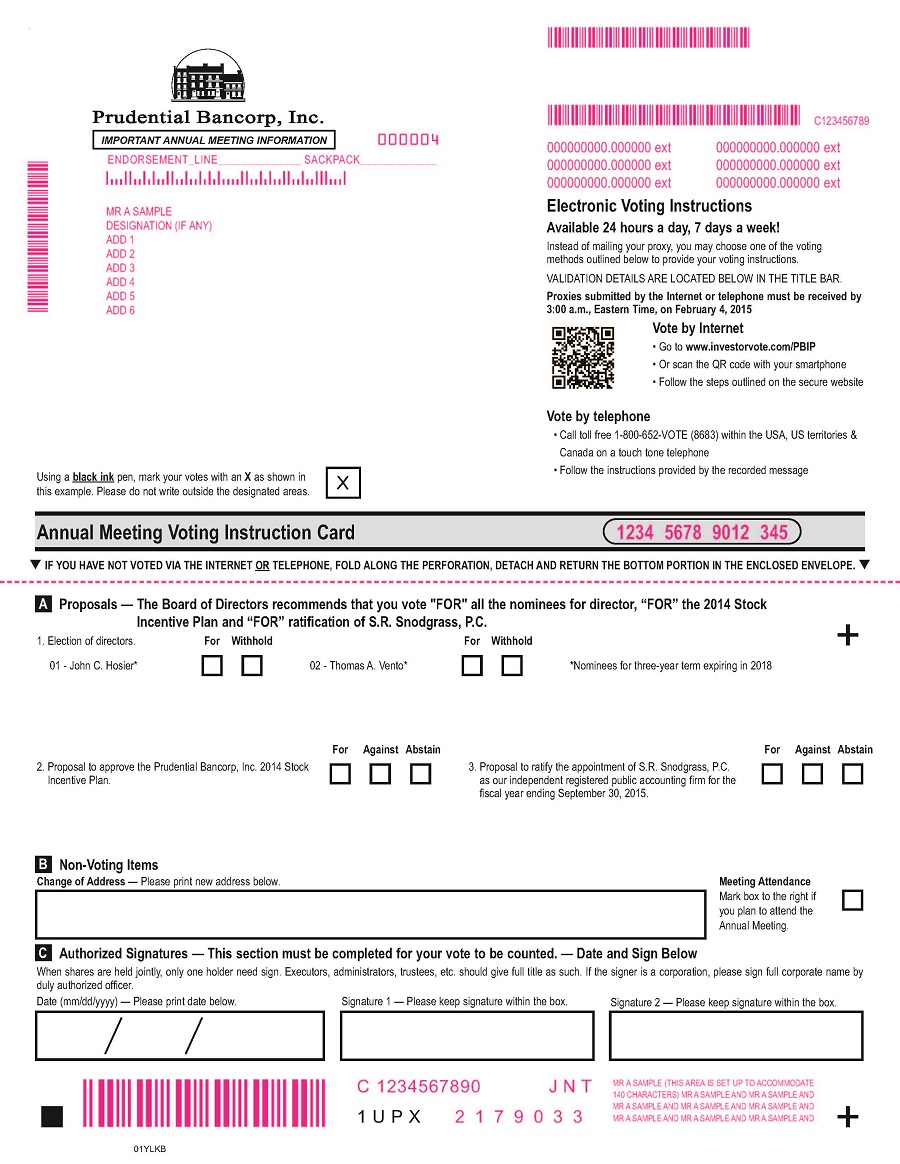

(1)To elect two directors for a three-year term and until their (2) year ending September 30, aware of any other such business. | ||

RECORD DATE | Holders of Prudential Bancorp common stock of record at the close of business on | |

ANNUAL REPORT | ||

Our | ||

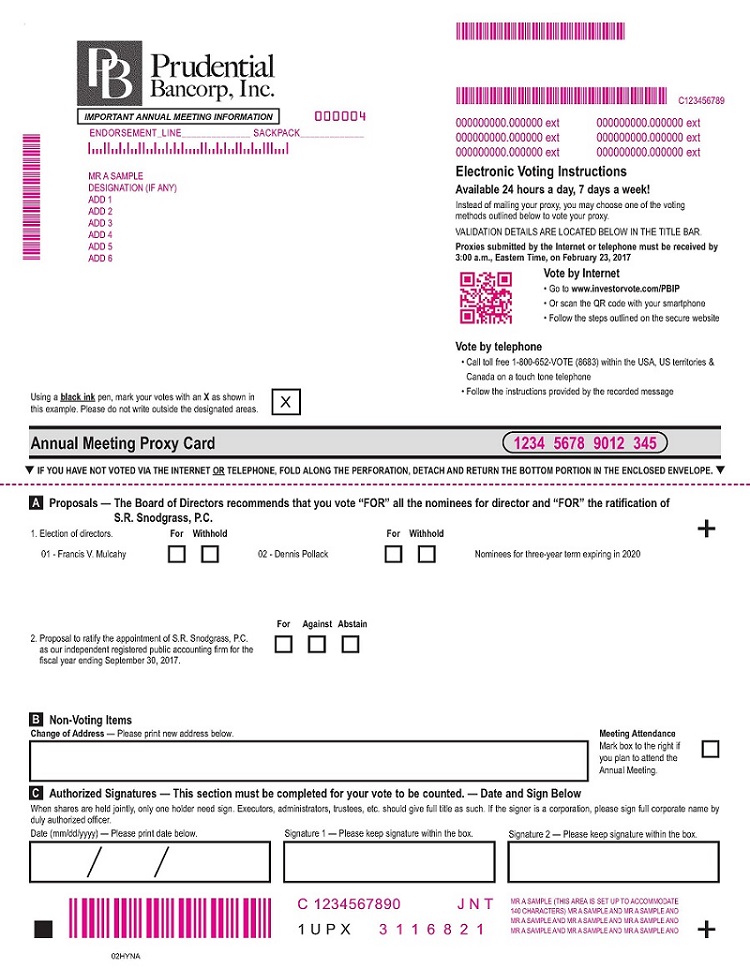

PROXY VOTING | It is important that your shares be represented and voted at the meeting. You are urged to vote your shares by completing and returning the proxy card sent to you. Most shareholders can also vote their shares over the Internet or by telephone. If Internet or telephone voting is available to you, voting instructions are printed on your proxy card or voting instruction form. You can revoke a proxy at any time prior to its exercise at the meeting by following the instructions in the accompanying proxy statement. | |

BY ORDER OF THE BOARD OF DIRECTORS | ||

Sharon M. Slater Corporate Secretary | ||

Philadelphia, Pennsylvania | January 20, 2017 | |

| TABLE OF CONTENTS | |

| Page | |

About the Annual Meeting of Shareholders | 1 |

| Information with Respect to Nominees for Director, Continuing Directors and Executive Officers | 3 |

| Election of Directors (Proposal One) | 3 |

| Members of the Board of Directors Continuing in Office | |

| Committees and Meetings of the Board of Directors | |

| Board Leadership Structure | |

| Board's Role in Risk Oversight | |

| Directors' Attendance at Annual Meetings | |

Directors' Compensation | 6 |

| Compensation Committee Interlocks and Insider Participation | |

Director Nominations | 7 |

| Executive Officers Who Are Not Also Directors | |

| Report of the Audit Committee | |

| | |

Management Compensation | 9 |

| Compensation Discussion and Analysis | 9 |

| Compensation Policies and Practices as They Relate to Management | 19 |

| Report of the Compensation Committee | 19 |

| Summary Compensation Table | |

| | |

| | |

| | |

| | |

| Potential Payments upon Termination of Employment or a Change in Control | 24 |

| Benefit Plans | 27 |

| Related Party Transactions | |

| | |

| Beneficial Ownership of Common Stock by Certain Beneficial Owners and Management | |

| Section 16(a) Beneficial Ownership Reporting Compliance | |

| Ratification of Appointment of Independent Registered Public Accounting Firm (Proposal | |

| Audit Fees | |

| Shareholder Proposals, Nominations and Communications with the Board of Directors | |

| | |

| | |

| | |

| Other Matters | 34 |

| MEETING | ||||

| DIRECTORS | ||||

| From | From | |||

Take Turn right | Turn right | Take Take Turn right onto Mill Road which changes to Warminster Road Stay on Turn left onto Huntingdon Pike and proceed to 3993 Huntingdon Pike | ||

| ABOUT THE ANNUAL MEETING OF SHAREHOLDERS |

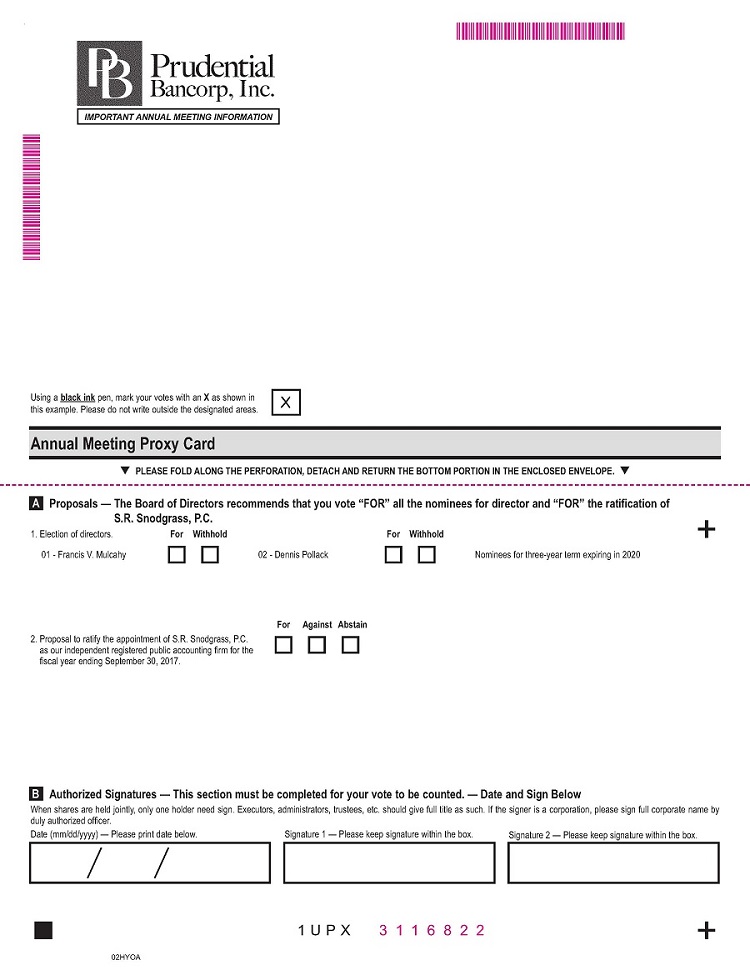

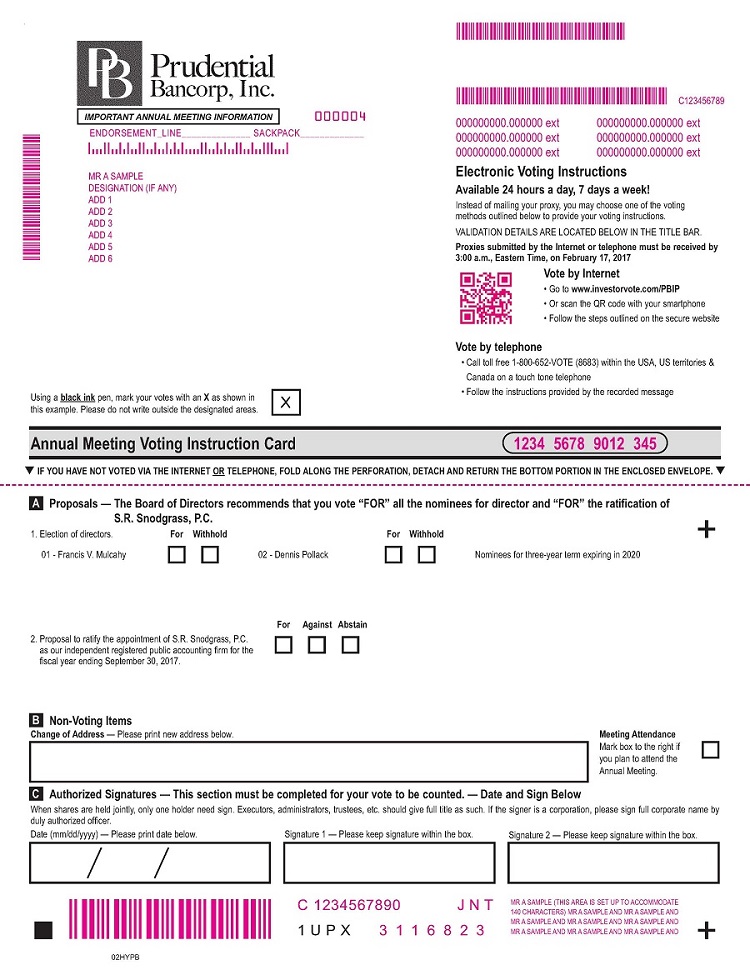

| elect two directors for a three-year term expiring in |

| ratify the appointment of S.R. Snodgrass, P.C. as our independent registered public accounting firm for the fiscal year ending September 30, |

| ● | First, you may complete and submit a new proxy card or vote over the Internet or by telephone before the annual meeting. Any earlier proxies will be revoked automatically. |

| ● | Second, you may send a written notice to our Corporate Secretary, Ms. Sharon M. Slater, Prudential Bancorp, Inc., 1834 West Oregon Avenue, Philadelphia, Pennsylvania 19145, in advance of the annual meeting stating that you would like to revoke your proxy. |

| ● | Third, you may attend the annual meeting and vote in person. Any earlier proxy will be revoked. However, attending the annual meeting without voting in person will not revoke your proxy. |

INFORMATION WITH RESPECT TO THE NOMINEES FOR DIRECTOR, CONTINUING DIRECTORS AND EXECUTIVE OFFICERS |

| Name | Age and Position with Prudential Bancorp and Principal Occupation During the Past Five Years | Director Since | ||

| Francis V. Mulcahy | Director. Mr. Mulcahy brings substantial knowledge of the local real estate market to the Board of | 2005 | ||

| Dennis Pollack | Director. President and Chief Executive Officer of Prudential Bancorp | |||

Mr. Pollack brings to the Board the benefit of his substantial experience as president, chief executive officer and director of community banking organizations as well as significant knowledge of community bank lending. Age 66. | 2014 | |||

| Name | Directors Whose Terms Expire in Age and Position with Prudential Bancorp and Principal Occupation During the Past Five Years | Director Since | ||

| John C. Hosier | Director. Commercial Lines Account Executive 2007, two full-service insurance agencies. Mr. 52. | |||

| Bruce E. Miller | 2000. Mr. Miller brings significant business experience to the Board as a result of his successful operation of a number of small businesses as well as extensive knowledge of the local market area in which the Bank operates. Age 55. | 2013 |

Directors Whose Terms Expire in 2019 Age and Position with Prudential Bancorp and Principal Occupation During the Past Five Years | Director Since | |

| Jerome R. Balka, Esq. | Director. Mr. Balka brings substantial legal expertise, particularly with respect to real estate | 2000 |

| A. J. Fanelli | Director. Self-employed owner of a public accounting practice, Philadelphia, Pennsylvania. Mr. Fanelli brings substantial accounting knowledge to the Board of Directors as Chairman of the Audit Committee. Age 79. | 2005 |

Directors | Nominating and Corporate Governance | Compensation | Audit | ||||

| A.J. Fanelli | ** | * | ** | ||||

| John C. Hosier | * | * | * | ||||

| Bruce E. Miller | * | * | * | ||||

| Francis V. Mulcahy | * | ** | * | ||||

| Name | Fees Earned or Paid in Cash | Stock Awards | Option Awards(1) | All Other Compensation(2) | Total | |||||||||||||||

| Jerome R. Balka, Esq. | $ | 35,997 | $ | -- | $ | -- | $ | 131, 974 | $ | 167,971 | ||||||||||

A. J. Fanelli | 62,200 | -- | -- | -- | 62,200 | |||||||||||||||

John C. Hosier | 54,900 | -- | -- | -- | 54,900 | |||||||||||||||

Bruce E. Miller | 51,300 | -- | 62,321 | -- | 113,621 | |||||||||||||||

Francis V. Mulcahy | 60,600 | -- | -- | -- | 60,600 | |||||||||||||||

Dennis Pollack (3) | -- | -- | -- | -- | -- | |||||||||||||||

| Name | Fees Earned or Paid in Cash | Stock Awards(1) | Option Awards | All Other Compensation | Total | |||||||||||||||

| Jerome R. Balka, Esq. | $ | 45,150 | $ | -- | $ | -- | $ | -- | $ | 45,150 | (1) | |||||||||

| A. J. Fanelli | 75,850 | -- | -- | -- | 78,850 | |||||||||||||||

| John C. Hosier | 73,950 | -- | -- | -- | 73,950 | |||||||||||||||

| Bruce E. Miller | 95,850 | -- | -- | -- | 95,850 | |||||||||||||||

| Francis V. Mulcahy | 71,550 | -- | -- | -- | 71,550 | |||||||||||||||

| Dennis Pollack | 40,400 | (2) | (3 | ) | (3 | ) | -- | 40,400 | ||||||||||||

| (1) |

| (2) | Reflects the cash compensation Mr. Pollack received as a non-employee director between October 1, 2015 and May 1, 2016 when he was appointed President and Chief Executive Officer. As an employee, in accordance with Prudential Bank's policy, he does not receive compensation for his service on the Board of Directors. |

| (3) | Pursuant to the 2014 Stock Incentive Plan ("2014 SIP"). Mr. Pollack was granted 2,500 shares of restricted stock and options to purchase |

| ensuring that the Board of Directors, as a whole, is diverse by considering: |

| o | individuals with various and relevant career experience; |

| o | relevant technical skills; |

| o | industry knowledge and experience; |

| o | financial expertise (including expertise that could qualify a director as a "financial expert," as that term is defined by the rules of the Securities and Exchange Commission); |

| o | local or community ties; and |

| minimum individual qualifications, including: |

| o | strength of character; |

| o | mature judgment; |

| o | familiarity with our business and industry; |

| o | independence of thought; and |

| o | an ability to work collegially. |

| Name | Age and Principal Occupation During the Past Five Years | |

Senior Vice President and Chief Lending Officer since January 1, 2017. Mr. Gallagher served as Chief Lending Officer of Polonia Bank from November 2015 until completion of the merger of Polonia Bank with and into Prudential | ||

| Jeffrey T. Hanuscin | First Vice President and Controller of Prudential Bancorp and Prudential Bank since September 2016 and Vice President and Controller of Prudential Bancorp from June 2013 to September 2016 and of Prudential |

| Name | Age and Principal Occupation During the Past Five Years | |

| Anthony V. Migliorino | Executive Vice President and Chief Operating Officer of Prudential Bank since September 2015; from July 2015 until September 2015 served as Senior Vice President-Retail Business Development Officer. From September 2000 to September 2014, Mr. Migliorino served in various positions at Sterling National Bank, New York, New York, including Senior Vice President of Branch Banking. Prior to 2000, Mr. Migliorino served as a senior officer at several financial institutions including Stissing National Bank, Pine Plains, New York and Savings Bank of Rockland County, Spring Valley, New York. Age 61. | |

| Jack E. Rothkopf | Senior Vice President, Chief Financial Officer and Treasurer of Prudential Bancorp and Prudential Bank since June 2015; Senior Vice President and Treasurer of Prudential Bancorp |

| REPORT OF THE AUDIT COMMITTEE |

| MANAGEMENT COMPENSATION |

| ● | annual base salary, |

| ● | annual cash bonuses, |

| ● | periodic grants of stock options and restricted stock awards, and |

| ● | other forms of compensation as approved by the Board of Directors, as appropriate, consisting principally of participation in an employee tax-qualified retirement plan consisting of a profit-sharing plan and medical, dental, life and related insurance programs. |

| ● | Salaries; |

| ● | Annual cash bonus awards; |

| ● | Long-term incentive compensation consisting of a mixture of stock options and restricted stock awards; and |

| ● | Certain other benefits. |

| ● | the financial condition and results of operations of the Company; |

| ● | individual performance of the executive; |

| ● | internal review of the executive's compensation, both individually and relative to other officers; |

| ● | peer and market data; and |

| ● | qualifications and experience of the officer. |

| Name and Principal Position | Fiscal Year | Salary | Bonus(1) | Stock Awards(2) | Option Awards(2) | All Other Compensation(3) | Total | |||||||||||||||||||||

Thomas A. Vento Chairman, President and Chief Executive Officer | 2014 2013 | $ | 343,105 333,111 | $ | 22,361 20,326 | $ | -- 45,711 | $ | -- 63,999 | $ | 68,714 | (4) 71,851 | $ | 434,180 534,998 | ||||||||||||||

Joseph R. Corrato Executive Vice President and Chief Financial Officer | 2014 2013 | 213,632 207,409 | 13,923 12,656 | -- 29,000 | -- 42,525 | 58,048 | (4) 59,613 | 285,603 351,203 | ||||||||||||||||||||

Salvatore Fratanduono Senior Vice President and Chief Lending Officer | 2014 2013 | 159,271 144,089 | 8,065 6,893 | -- 15,950 | -- 19,688 | 10,563 5,951 | 177,899 192,570 | |||||||||||||||||||||

Name and Principal Position | Fiscal Year | Salary | Bonus(1) | Stock Awards(2) | Option Awards(2) | Change in Pension Value and Nonqualified Deferred Compensation Earnings(3) | All Other Compensation(4) | Total | ||||||||||||||||||||||||

Dennis Pollack(5) President and Chief Executive Officer | 2016 | $ | 108,462 | $ | 20,000 | $ | 36,050 | $ | 21,300 | $ | -- | $ | 4,125 | (4)(6) | $ | 189,937 | ||||||||||||||||

Joseph R. Corrato(5) President and Chief Executive Officer | 2016 2015 2014 | 170,184 235,382 213,632 | -- -- 13,923 | -- 366,900 -- | -- 343,500 -- | 212,000 202,000 144,000 | 75,057 65,471 76,641 | (4)(6) | 455,241 1,213,253 448,196 | |||||||||||||||||||||||

Anthony V. Migliorino(7) Executive Vice President and Chief Operating Officer | 2016 2015 | 172,368 33,750 | 20,000 -- | 108,150 -- | 31,950 -- | -- -- | 690 750 | (6) | 333,158 24,500 | |||||||||||||||||||||||

Jeffrey T. Hanuscin First Vice President/Controller | 2016 2015 2014 | 120,495 120,120 114,583 | 10,000 -- 3,000 | -- 61,150 -- | -- 50,380 -- | 9,000 15,000 4,000 | 16,690 11,978 100 | (4) | 156,185 258,628 121,683 | |||||||||||||||||||||||

Jack E. Rothkopf Senior Vice President, Chief Financial Officer and Treasurer | 2016 2015 2014 | 156,912 160,681 151,477 | 5,000 -- 4,986 | -- 183,450 -- | -- 229,000 -- | 39,000 46,000 31,000 | 28,894 16,491 9,541 | (4) | 229,806 635,622 197,004 | |||||||||||||||||||||||

| (1) | Represents discretionary bonuses earned in each fiscal |

| (2) | Reflects the grant date fair value in accordance with FASB ASC Topic 718 for awards of restricted stock and stock options that were granted during the fiscal |

| (3) | Represents the sum of the actuarial change in pension value in plan years 2013, 2014 and 2015 for Messrs. Corrato, Hanuscin and Rothkopf pursuant to their participation in the Defined Benefit Plan, a multiple employer tax-qualified defined benefit plan. The amounts reflect the effect of the adoption of the new mortality table (RP-2014). Messrs. Pollack and Migliorino are not participating in the Defined Benefit Plan. |

Includes the fair market value on December |

| (5) | Effective as of May 1, 2016, Mr. Pollack was appointed President and Chief Executive Officer of the Company and Prudential Bank and Mr. Corrato resigned as President and Chief Executive Officer of both entities. Mr. Corrato was appointed, effective as of May 1, 2016, as a director emeritus. Thus, Mr. Pollack's salary data for fiscal 2016 only reflects five months of salary. |

| Includes, |

| (7) | Mr. Migliorino joined Prudential Bank in June 2015. Accordingly, his salary amount for |

| Name | Grant Date | All Other Stock Awards: Number of Shares of Stock or Units(1) | All Other Option Awards: Number of Securities Underlying Options(2) | Exercise or Base Price of Option Awards(3) | Grant Date Fair Value of Stock and Option Awards(4) | |||||||||||||

| Dennis Pollack | 8/17/2016 | 2,500 | -- | $ | -- | $ | 36,050 | |||||||||||

| 8/17/2016 | -- | 10,000 | 14.42 | 21,300 | ||||||||||||||

| Anthony V. Migliorino | 8/17/2016 | 7,500 | -- | -- | 108,150 | |||||||||||||

| 8/17/2016 | -- | 15,000 | 14.42 | 31,950 | ||||||||||||||

| (1) | The restricted stock awards granted August 17, 2016 vests at the rate of 20% per year, starting August 17, 2017. |

| (2) | The stock options granted vests at the rate of 20% per year, starting August 17, 2017. |

| (3) | Based upon the fair market value of a share of Company common stock on the date of grant. |

| (4) | The fair value of the restricted stock awards and/or stock options granted is computed in accordance with FASB ASC Topic 718. |

| Stock Awards(1) | |||||||||||||||||||||

| Market Value | |||||||||||||||||||||

| Option Awards(1) | Number of Shares | of Shares or | |||||||||||||||||||

| Number of Securities Underlying | Option | or Units of Stock | Units of Stock | ||||||||||||||||||

| Unexercised Options | Exercise | Expiration | That Have Not | That Have Not | |||||||||||||||||

| Name | Exercisable | Unexercisable | Price | Date | Vested | Vested(2) | |||||||||||||||

| Thomas A. Vento | 106,764 3,836 | (3) | -- 15,347 | (4) | $ | 11.84 7.68 | 1/5/2019 1/5/2023 | 4,763 | (4) | $ | 58,251 | ||||||||||

| Joseph R. Corrato | 53,382 2,549 | (3) | -- 10,197 | (4) | 11.84 7.68 | 1/5/2019 1/5/2023 | 3,021 | (4) | 36,947 | ||||||||||||

| Salvatore Fratanduono | 21,353 1,180 | (3) | -- 4,721 | (4) | 11.84 7.68 | 1/5/2019 1/5/2023 | 1,662 | (4) | 20,326 | ||||||||||||

| Stock Awards(1) | ||||||||||||||||||||||||

| Market Value | ||||||||||||||||||||||||

| Option Awards(1) | Number of Shares | Of Shares or | ||||||||||||||||||||||

| Number of Securities Underlying | Option | Or Units of Stock | Units of Stock | |||||||||||||||||||||

| Unexercised Options | Exercise | Expiration | That Have Not | That Have Not | ||||||||||||||||||||

| Name | Exercisable | Unexercisable | Price | Date | Vested | Vested(2) | ||||||||||||||||||

Dennis Pollack | 6,000 | (3) | 24,000 | $ | 12.23 | 2/18/2025 | 8,000 | (3) | $ | 115,840 | ||||||||||||||

| -- | 10,000 | (4) | 14.42 | 8/172026 | 2,500 | (4) | 36,200 | |||||||||||||||||

| Joseph R. Corrato. | 53,382 | (5) | -- | 11.84 | 1/5/2019 | 1,511 | (6) | 21,789 | ||||||||||||||||

| 7,647 | (6) | 5,099 | 7.68 | 1/5/2023 | 24,000 | (3) | 346,080 | |||||||||||||||||

| 15,000 | (3) | 60,000 | 12.23 | 2/18/2025 | ||||||||||||||||||||

| Anthony V. Migliorino | -- | 15,000 | (4) | 14.42 | 8/17/2026 | 7,500 | (4) | 108,150 | ||||||||||||||||

| Jack E. Rothkopf | 18,683 | (5) | -- | 11.84 | 1/5/2019 | 832 | (4) | 11,997 | ||||||||||||||||

| 3,540 | (6) | 2,361 | 7.68 | 1/5/2023 | 12,000 | (5) | 173,040 | |||||||||||||||||

| 10,000 | (3) | 40,000 | 12.23 | 2/18/2025 | ||||||||||||||||||||

| Jeffrey T. Hanuscin | 6,102 | (7) | 4,069 | 10.24 | 6/19/2023 | 1,474 | (7) | 21,255 | ||||||||||||||||

| 2,200 | (3)(6) | 8,800 | 12.23 | 2/18/2025 | 4,000 | (3) | 57,680 | |||||||||||||||||

| (1) | Each of the option awards and stock awards outstanding as of October 9, 2013 was converted into an option award or stock award to purchase a number of shares of common stock of Prudential Bancorp equal to the product of the number of shares of common stock multiplied by the exchange ratio of 0.9442, rounded down to the nearest whole share. Each option after the exchange has an adjusted exercise price equal to the quotient obtained by dividing the option exercise price by the exchange ratio of 0.9442, rounded up to the nearest whole cent. |

| (2) | Calculated by multiplying the closing market price per share of our common stock on September 30, |

| (3) | Granted pursuant to our 2014 Stock Incentive Plan and vest at a rate of 20% per year commencing on February 18, 2016. |

| Granted pursuant to our 2008 Stock Option Plan, our 2014 Stock Incentive Plan and our 2008 Recognition and Retention Plan, as applicable, and vest at a rate of 20% per year commencing on August 17, 2017. |

| (5) | Granted pursuant to our 2008 Stock Option Plan and our 2008 Recognition and Retention Plan, as applicable, and vested at a rate of 20% per year commencing on January 5, 2010, becoming fully vested on January 5, 2014. |

| Granted pursuant to our 2008 Stock Option Plan and 2008 Recognition and Retention Plan, as applicable, and vest at a rate of 20% per year commencing on January 5, 2014. |

| (7) | Granted pursuant to our 2008 Stock Option Plan and our 2008 Recognition and Retention Plan, as applicable, and vest at a rate of 20% per year commencing on June 19, 2014. |

| Stock Awards | |||||||||

| Name | Number of Shares Acquired On Vesting(1) | Value Realized On Vesting(2) | |||||||

| Dennis Pollack | 2,000 | $ | 30,600 | ||||||

| Joseph R. Corrato | 755 | 11,265 | |||||||

| 6,000 | 91,800 | ||||||||

| Jack E. Rothkopf | 415 | 6,192 | |||||||

| 3,000 | 45,900 | ||||||||

| Jeffrey T. Hanuscin | 736 | 10,981 | |||||||

| 1,000 | 15,300 | ||||||||

| (1) | Does not reflect the sale or withholding of shares to satisfy income tax withholding obligations. |

| (2) | Based upon the fair market value of a share of Company common stock on the date of exercise or vesting. Value is calculated by multiplying the number of shares of Company common stock that vested by the fair market value on the date of vesting. |

| Payments and Benefits | Voluntary Termination | Termination for Cause | Involuntary Termination Without Cause or Termination by the Executive for Good Reason Absent a Change in Control | Change in Control With Termination of Employment | Death or Disability (j) | Retirement | ||||||||||||||||||

| Severance payments and benefits: (a) | ||||||||||||||||||||||||

| Cash severance (b) | $ | -- | $ | -- | $ | -- | $ | -- | $ | -- | $ | -- | ||||||||||||

| Medical and other insurance benefits (c) | -- | -- | 1,853 | 3,706 | -- | -- | ||||||||||||||||||

| Automobile expenses (d) | -- | -- | -- | -- | -- | -- | ||||||||||||||||||

| §280G cut-back (e) | -- | -- | -- | -- | -- | -- | ||||||||||||||||||

| Equity awards: (f) | ||||||||||||||||||||||||

| Unvested stock options (g) | -- | -- | -- | 54,600 | 54,600 | -- | ||||||||||||||||||

| Unvested restricted stock awards (h) | -- | -- | -- | 152,040 | 152,040 | -- | ||||||||||||||||||

| Total payments and benefits (i) | $ | -- | $ | -- | $ | 1,853 | $ | 210,346 | $ | 206,640 | $ | -- | ||||||||||||

| Payments and Benefits | Voluntary Termination | Termination for Cause | Involuntary Termination Without Cause or Termination by the Executive for Good Reason Absent a Change in Control | Change in Control With Termination of Employment | Death or Disability (j) | Retirement | ||||||||||||||||||

| Severance payments and benefits: (a) | ||||||||||||||||||||||||

| Cash severance (b) | $ | -- | $ | -- | $ | -- | $ | 315,478 | $ | -- | $ | -- | ||||||||||||

| Medical and other insurance benefits (c) | -- | -- | -- | 13,992 | -- | -- | ||||||||||||||||||

| Automobile expenses (d) | -- | -- | -- | 2,760 | -- | -- | ||||||||||||||||||

| §280G cut-back (e) | -- | -- | -- | -- | -- | -- | ||||||||||||||||||

| Equity awards: (f) | ||||||||||||||||||||||||

| Unvested stock options (g) | -- | -- | -- | 900 | 900 | -- | ||||||||||||||||||

| Unvested restricted stock awards (h) | -- | -- | -- | 108,600 | 108,600 | -- | ||||||||||||||||||

| Total payments and benefits (i) | $ | -- | $ | -- | $ | -- | $ | 441,730 | $ | 109,500 | $ | -- | ||||||||||||

| Payments and Benefits | Voluntary Termination | Termination for Cause | Involuntary Termination Without Cause or Termination by the Executive for Good Reason Absent a Change in Control | Change in Control With Termination of Employment | Death or Disability (j) | Retirement | ||||||||||||||||||

| Severance payments and benefits: (a) | ||||||||||||||||||||||||

| Cash severance (b) | $ | -- | $ | -- | $ | 272,158 | $ | 272,158 | $ | -- | $ | -- | ||||||||||||

| Medical and other insurance benefits (c) | -- | -- | 886 | 886 | -- | -- | ||||||||||||||||||

| Automobile expenses (d) | -- | -- | -- | -- | -- | -- | ||||||||||||||||||

| §280G cut-back (e) | -- | -- | -- | -- | -- | -- | ||||||||||||||||||

| Equity awards: (f) | ||||||||||||||||||||||||

| Unvested stock options (g) | -- | -- | -- | 106,055 | 106,055 | -- | ||||||||||||||||||

| Unvested restricted stock awards (h) | -- | -- | -- | 185,807 | 185,807 | -- | ||||||||||||||||||

| Total payments and benefits (i) | $ | -- | $ | -- | $ | 273,044 | $ | 564,906 | $ | 291,862 | $ | -- | ||||||||||||

| Payments and Benefits | Voluntary Termination | Termination for Cause | Involuntary Termination Without Cause or Termination by the Executive for Good Reason Absent a Change in Control | Change in Control With Termination of Employment | Death or Disability (j) | Retirement | ||||||||||||||||||

| Severance payments and benefits: (a) | ||||||||||||||||||||||||

| Cash severance (b) | $ | -- | $ | -- | $ | -- | $ | 121,297 | $ | -- | $ | -- | ||||||||||||

| Medical and other insurance benefits (c) | -- | -- | -- | 7,864 | -- | -- | ||||||||||||||||||

| Automobile expenses (d) | -- | -- | -- | -- | -- | -- | ||||||||||||||||||

| §280G tax cut back (e) | -- | -- | -- | -- | -- | -- | ||||||||||||||||||

| Equity awards: (f) | ||||||||||||||||||||||||

| Unvested stock options (g) | -- | -- | -- | 37,053 | 37,053 | -- | ||||||||||||||||||

| Unvested restricted stock awards (h) | -- | -- | -- | 79,264 | 79,264 | -- | ||||||||||||||||||

| Total payments and benefits (i) | $ | -- | $ | -- | $ | -- | $ | 245,478 | $ | 116,317 | $ | -- | ||||||||||||

| (a) | These severance payments and benefits are payable if the employment of Mr. Pollack or Mr. Rothkopf is terminated prior to a change in control either (i) by the Bank for any reason other than cause, disability, retirement or death or (ii) by Mr. Pollack or Mr. Rothkopf if the Bank takes certain adverse actions (a "good reason" termination). The severance payments and benefits are also payable if an executive's employment is terminated concurrently with or following a change in control if the termination of employment occurs during the term of Mr. Pollack's or Mr. Rothkopf's employment agreement (the term of Mr. Rothkopf's agreement expired as of December 31, 2016) or during the term of Mr. Migliorino's or Hanuscin's severance agreement. Under Mr. Rothkopf's new change in control agreement, he is entitled to severance payments and benefits only in the event of his termination concurrently with or following a change in control. In addition, under Mr. Pollack's amended and restated employment agreement, the severance benefits have been enhanced and under Mr. Migliorino's new employment agreement, he is entitled to severance in an involuntary separation outside a change in control and to an enhanced level of severance. |

| (b) | If the employment of Mr. Pollack or Mr. Rothkopf is terminated prior to a change in control, represents a lump sum payment equal to one time the average of the base salary and cash bonus received by Mr. Pollack (excluding any deferred amounts) during the five calendar years preceding the year in which the date of termination occurs and two times such amount for Mr. Rothkopf. In the change in control column, represents a lump sum payment equal to two times for Messrs. Pollack, Migliorino and Rothkopf and one time for Mr. Hanuscin the average of the executive's base salary and cash bonus received by the executive (excluding any deferred amounts) during the five calendar years preceding the year in which the date of termination occurs. Since Mr. Pollack did not have any cash compensation as an employee in calendar 2015, he would not have received any cash severance payments had his employment been terminated as of September 30, 2016. |

| (c) | If the employment of Mr. Pollack or Mr. Rothkopf is terminated prior to a change in control, represents the estimated present value cost of providing continued medical, dental, vision, life and accidental death and disability coverage to Messrs. Pollack and Rothkopf for an assumed additional 12 months and 24 months, respectively, at no cost to the executives. In the change in control column, represents the estimated present value cost of providing continued medical, dental, vision, life and accidental death and disability coverage for 24 months for Messrs. Pollack, Migliorino and Rothkopf (12 months for Mr. Hanuscin) at no cost to the executives. The estimated costs assume the current insurance premiums with no increase in the annual premium costs. The amounts have not been discounted to present value. |

| (d) | Represents a lump sum cash payment equal to the estimated costs of paying automobile related expenses for Mr. Migliorino for an assumed 24 months if his employment is terminated concurrently with or following a change in control), based on the amounts paid. |

| (e) | If the parachute amounts associated with the payments and benefits to Messrs. Pollack, Migliorino, Rothkopf and Hanuscin in the change in control column equal or exceed three times the executive's average taxable income for the five calendar years immediately preceding the year in which the change in control occurs, such payments and benefits in the event of a change of control will be reduced by the minimum amount necessary so that they do not trigger the 20% excise tax imposed by Sections 280G and 4999 of the Internal Revenue Code. Based upon the assumptions made, each executive is below his respective Section 280G threshold. |

| (f) | The vested stock options held by Messrs. Pollack, Migliorino, Rothkopf and Hanuscin had a value of approximately $13,500, $0, $73,795 and $34,362, respectively, based on the September 30, 2016 closing price of $14.48 per share. Such value can be obtained in the event of termination due to voluntary termination, death, disability, retirement or cause only if the executive actually exercises the vested options in the manner provided for by the relevant option plan and subsequently sells the shares received for $14.48 per share. In the event of a termination of employment, each executive (or his or her estate in the event of death) will have the right to exercise vested stock options for the period specified in his or her option grant agreement. If the termination of employment occurs following a change in control, each executive can exercise the vested stock options for the remainder of the original ten-year term of the option. |

| (g) | Represents the value of the unvested stock options held by Messrs. Pollack, Migliorino, Rothkopf and Hanuscin that had an exercise price below the September 30, 2016 closing price of $14.48 per share, based on the difference between the September 30, 2016 closing price and the per share exercise price of the unvested stock options. All unvested stock options will become fully vested upon an executive's death, disability or upon a change in control. |

| (h) | Represents the value of the unvested restricted stock awards held by Messrs. Pollack, Migliorino, Rothkopf and Hanuscin based on the September 30, 2016 closing price of $14.48 per share, excluding accumulated cash dividends, if any, on the unvested shares for each of the executives. All unvested restricted stock awards will become fully vested upon an executive's death or disability or upon a change in control. |

| (i) | Does not include the value of the vested benefits to be paid under our tax-qualified defined benefit pension plan, 401(k) plan and ESOP. See the pension benefits table under "-Benefit Plans – Retirement Plan" below. The ESOP was terminated effective December 31, 2016, with the value of the unallocated ESOP shares held in the suspense account to first be used to repay the outstanding balance of the ESOP loan and with any remaining balance in the suspense account to then be allocated among the ESOP participants on a pro rata basis. The above tables do not include any additional ESOP allocations that will be made upon the termination of the ESOP. Also does not include the value of vested stock options set forth in Note (f) above, earned but unpaid salary, accrued but unused vacation leave and reimbursable expenses. |

| (j) | If the employment of Mr. Pollack, Mr. Migliorino, Mr. Rothkopf or Mr. Hanuscin had terminated at September 30, 2016 due to death, his or her beneficiaries or estate would have received life insurance proceeds of approximately $570,000, $400,000, $153,000 and $120,120, respectively. If the employment of Mr. Pollack, Mr. Migliorino, Mr. Rothkopf or Mr. Hanuscin had terminated at September 30, 2016 due to disability, they each would have received disability benefits under our disability policy of $12,000 per year. |

| Name | Plan Name | Number of Years Credited Service | Present Value of Accumulated Benefit(2) | Payments During Last Fiscal Year | ||||||||||

| Dennis Pollack | Financial Institutions Retirement Fund(1) | 0 | $ | -- | $ | -- | ||||||||

Joseph R. Corrato(3) | Financial Institutions Retirement Fund(1) | 30 | 1,217,000 | -- | ||||||||||

| Jeffrey T. Hanuscin | Financial Institutions Retirement Fund(1) | 2 | 28,000 | -- | ||||||||||

| Anthony V. Migliorino | Financial Institutions Retirement Fund(1) | 0 | -- | -- | ||||||||||

| Jack E. Rothkopf | Financial Institutions Retirement Fund(1) | 9 | 186,000 | -- | ||||||||||

Amounts Paid During Year | ||||||||||||||||||||||||

| Largest Principal | ||||||||||||||||||||||||

| Amount | Amount | |||||||||||||||||||||||

| Year ended | Outstanding | Outstanding at | Interest | |||||||||||||||||||||

| Name | September 30, | During Year | Year-End | Principal | Interest | Rate | ||||||||||||||||||

| Joseph R. Corrato | 2016 2015 | $ | 212,790 224,288 | $ | 200,645 212,790 | $ | 12,145 11,498 | $ | 5,694 6,024 | 2.750 | % 2.750 | |||||||||||||

| John C. Hosier | 2016 2015 | 378,527 387,620 | 369,147 378,527 | 9,380 9,692 | 11,695 4,984 | 3.125 3.125 | ||||||||||||||||||

| Jack E. Rothkopf | 2016 2015 | 169,140 174,081 | 164,040 169,140 | 5,100 4,941 | 5,210 5,370 | 3.125 3.125 | ||||||||||||||||||

BENEFICIAL OWNERSHIP OF COMMON STOCK BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership as of January 9, 2017(1)(2) | Percent of Common Stock | ||||||

Firefly Value Partners, LP 601 West 26th Street Suite 1520 New York, New York 10001 | 475,250 | (3) | 5.3 | % | ||||

Warren A. Mackey 40 Worth Street, 10th Floor New York, New York 10013 | 871,204 | (4) | 9.7 | % | ||||

Lawrence B. Seidman 100 Misty Lane, 1st Floor Parsippany, New Jersey 07054 | 750,318 | (5) | 8.3 | % | ||||

Directors: | ||||||||

Jerome R. Balka, Esq. | 70,933 | (6)(7) | * | |||||

A. J. Fanelli | 63,171 | (6)(8) | * | |||||

John C. Hosier | 62,939 | (6)(9) | * | |||||

Bruce E. Miller | 56,088 | (6) | * | |||||

Francis V. Mulcahy | 67,031 | (6)(10) | * | |||||

Dennis Pollack | 46,936 | (6)(11) | * | |||||

| Certain Executive Officers | ||||||||

Anthony V. Migliorino | 11,022 | (6)(12) | * | |||||

Jack E. Rothkopf | 72,358 | (6)(13) | * | |||||

Jeffrey T. Hanuscin | 20,995 | (6)(14) | * | |||||

| All Directors and Executive Officers as a Group (10 persons) | 471,473 | (7) | 5.1 | % | ||||

Name of Beneficial Owner or Number of Persons in Group | Amount and Nature of Beneficial Ownership as of December 19, 2014(1) | Percent of Common Stock(2) | ||||||

Prudential Savings Bank Employee Stock Ownership Plan 1834 West Oregon Avenue Philadelphia, Pennsylvania 19145 | 697,302 | (3) | 7.4 | % | ||||

EJF Capital LLC 2107 Wilson Boulevard, Suite 410 Arlington, Virginia 22201 | 494,146 | (4) | 5.3 | % | ||||

Warren A. Mackey 40 Worth Street, 10th Floor New York, New York 10013 | 871,204 | (5) | 9.3 | % | ||||

Lawrence B. Seidman 100 Misty Lane, 1st Floor Parsippany, New Jersey 07054 | 571,664 | (6) | 6.1 | % | ||||

Directors: | ||||||||

Jerome R. Balka, Esq. | 52,933 | (7)(8) | * | |||||

Joseph R. Corrato | 94,992 | (7)(9) | 1.0 | % | ||||

A. J. Fanelli | 41,171 | (7)(10) | * | |||||

John C. Hosier | 35,304 | (7)(11) | * | |||||

Bruce E. Miller | 19,617 | (7) | * | |||||

Francis V. Mulcahy | 43,029 | (7)(12) | * | |||||

Dennis Pollack | 11,500 | (13) | ||||||

Thomas A. Vento. | 191,414 | (7)(14) | 2.0 | % | ||||

| Other Named Executive Officer: | ||||||||

Salvatore Fratanduono | 39,408 | (7)(15) | * | |||||

| All Directors and Executive Officers as a group (11 persons) | 570,696 | (7) | 5.9 | % | ||||

| (1) | Based upon filings made pursuant to the Securities Exchange Act of 1934 and information furnished by the respective individuals. In addition, due to share repurchases by the Company, the ownership percentages reflected in the filings may differ from the percentages reflected in the table above. Furthermore, share ownership reflected on Schedules 13D and 13G may differ from what is actually held by the reporting persons as of January 9, 2017 due to changes in ownership which were not required to be reported prior to such date. In addition, does not reflect shares that may have been received in the merger with Polonia Bancorp by (i) shareholders of the Company who owned in excess of 5% of the Company's common stock who were also shareholders of Polonia Bancorp or who received a number of shares of common stock such that they would be beneficial owners of more than 5% of the Company's common stock, or (ii) who were shareholders of Polonia Bancorp who received sufficient shares to become beneficial owners of more than 5% of the Company's common stock. Under regulations promulgated pursuant to the Securities Exchange Act of 1934, shares of common stock are deemed to be beneficially owned by a person if he or she directly or indirectly has or shares (i) voting power, which includes the power to vote or to direct the voting of the shares, or (ii) investment power, which includes the power to dispose or to direct the disposition of the shares. Unless otherwise indicated, the named beneficial owner has sole voting and dispositive power with respect to the shares. |

| (2) | Each beneficial owner's percentage ownership is determined by assuming that options held by such person (but not those held by any other person) and that are exercisable within 60 days of |

| (3) |

| Based on a Schedule |

| Based on a Schedule 13D/A filed with the |

| Based on a Schedule 13D/A filed on |

| Includes shares held in trust by |

| Name | RRP Shares | Stock Options | Restricted Stock | Stock Options | ||||||||||||

| Jerome R. Balka, Esq. | -- | 26,690 | 8,000 | 34,690 | ||||||||||||

| Joseph R. Corrato | 3,021 | 58,480 | ||||||||||||||

| A.J. Fanelli | -- | 26,690 | 8,000 | 38,690 | ||||||||||||

| John C. Hosier | 5,338 | 18,683 | 9,068 | 36,021 | ||||||||||||

| Bruce E. Miller | 4,271 | 8,007 | 9,070 | 30,683 | ||||||||||||

| Francis V. Mulcahy | -- | 26,690 | 8,000 | 38,690 | ||||||||||||

| Dennis Pollack | -- | -- | 10,500 | 12,000 | ||||||||||||

| Thomas A. Vento | 4,763 | 114,436 | ||||||||||||||

| Salvatore Fratanduono | 1,662 | 23,713 | ||||||||||||||

| All directors and executive officers as a group (11 persons) | 23,663 | 326,466 | ||||||||||||||

| Anthony V. Migliorino | 7,500 | -- | ||||||||||||||

| Jack E. Rothkopf | 12,416 | 43,403 | ||||||||||||||

| Jeffrey T. Hanuscin | 5,474 | 10,502 | ||||||||||||||

| All directors and executive officers as a group (9 persons) | 78,028 | 244,679 | ||||||||||||||

| Includes 4,721 shares held in Mr. Balka's individual retirement account, 14,375 shares held jointly with Mr. Balka's spouse, 1,888 shares held in Mr. Balka's 401(k) Plan and 66 shares held by the estate of Helen Klara for whom Mr. Balka is guardian. Also includes 4,721 shares held by the Balka Grandchildren Trust and 472 shares held by the Danielle Thomas Revocable Trust, over which Mr. Balka disclaims beneficial ownership. |

| Includes 3,304 shares held jointly with Mr. Fanelli's spouse. |

| Includes |

| Includes |

| Includes |

| (12) | Includes 1,522 shares allocated to Mr. |

| (13) | Includes 7,908 shares allocated to Mr. Rothkopf's account in the Prudential Bank employee stock ownership |

| (14) | Includes |

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (PROPOSAL TWO) |

| Year Ended September 30, | Year Ended September 30, | |||||||||||||||

| 2014 | 2013 | 2016 | 2015 | |||||||||||||

Audit fees (1) | $ | 161,257 | $ | 166,362 | $ | 178,000 | $ | 169,858 | ||||||||

Audit-related fees | -- | -- | -- | -- | ||||||||||||

Tax fees (2) | 24,564 | 24,897 | 20,300 | 22,770 | ||||||||||||

All other fees | -- | -- | 9,000 | -- | ||||||||||||

Total | $ | 185,821 | $ | 191,259 | $ | 207,300 | $ | 192,628 | ||||||||

| (1) | Audit fees consist of fees incurred in connection with the audit of our annual financial statements and the review of the interim financial statements included in our quarterly reports filed with the Securities and Exchange Commission, as well as work generally only the independent auditor can reasonably be expected to provide, such as statutory audits, consents and assistance with and review of documents filed with the Securities and Exchange Commission. |

| (2) | Tax fees consist of compliance fees for the preparation of tax returns during fiscal |

| (3) | Consists of fees related to registration statements filed by the Company during fiscal 2016 with the Securities and Exchange Commission. |

SHAREHOLDER PROPOSALS, NOMINATIONS AND COMMUNICATIONS WITH THE BOARD OF DIRECTORS |

| ANNUAL REPORTS |

| OTHER MATTERS |